ACO Performance: A Deeper Look

The 2014 results are in for 333 Medicare Shared Savings Program (MSSP) accountable care organizations (ACOs) that started in 2012, 2013, and 2014—and the data do not exactly make for a typical college bell curve:

- Ninety-two ACOs (28 percent) exceeded their minimum savings requirement, generating total savings of about $806 million.

- Eighty-six of those 92 will receive $341 million as their share of the savings; the six others did not successfully report quality information.

- An additional 89 ACOs (26 percent) generated savings, but not enough to exceed their minimum savings requirement.

- For 152 (46 percent) ACOs, spending for care exceeded expected levels. Most of those were in “upside-only” arrangements and thus did not owe a penalty to Medicare.

With only 28 percent of ACOs receiving a share of savings in 2014, it is worth taking a deeper look at the results.

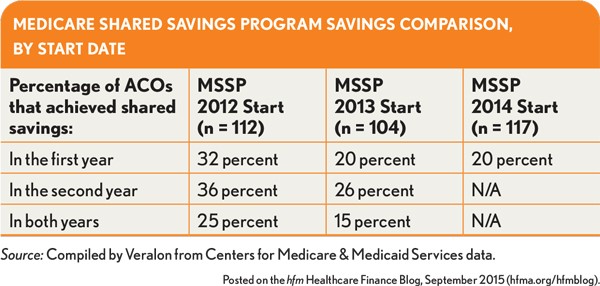

As seen in the table below, second-year ACOs have performed only slightly better than first-year program participants. The proportion sharing in savings in year two increased from 32 percent to 36 percent among the 2012 starters, and from 20 percent to 26 percent among 2013 starters. That still leaves a lot of disappointed ACOs.

Nor did experience guarantee sustained improvement. About a quarter of ACOs that achieved success in their first year did not do so the next year.

There may have been some self-selection in the early-start group. In other words, the earliest entrants may have been more ready to tackle accountable care or perhaps jumped in because they were in markets with ample room for improvement. Indeed, ACOs that started in 2012 have been performing 10 to 12 percentage points better than 2013 starters in terms of the proportion of participants receiving shared savings.

Implications for Accountable Care

Given that almost three-quarters of ACOs did not receive a shared-savings bonus in 2014, it’s clear that this work is not easy. But there are some helpful takeaways.

Health systems often realize strategic benefits from ACOs. Even without shared savings, health systems have used ACOs to improve physician alignment, reduce readmission penalties, secure market share, and support a focus on value-based care.

Health systems likely can worry less about competition from physician-sponsored ACOs. Physicians have little to gain beyond savings, meaning physician ACOs that don’t achieve savings are likely to disappear. The newest data may discourage formation of such ACOs by physicians. However, physicians may still want to participate in ACOs developed by others to obtain better payment rates under future Medicare payment models as defined in the Medicare Access and CHIP Reauthorization Act (the SGR repeal).

The Centers for Medicare & Medicaid Services (CMS) may continue to modify the rules to keep providers interested in the MSSP. As with any value-based payer arrangement, the payer has to put enough on the table to attract providers. CMS has indicated a continuing commitment to ACOs, which have driven meaningful change in care delivery. The agency has adjusted the terms under which organizations would apply for ACO participation or renew their contracts in 2016 and beyond, allowing ACOs more time in an upside-only arrangement before being required to take on risk.

CMS should be open to making additional improvements to the terms, such as not resetting the benchmark after the first contract period or lowering the minimum savings required for smaller organizations. The possibility of further changes to the ACO program merits monitoring, as do political developments following the 2016 election.